Europe Oil Free Air Compressors Market Size, Share, Trends & Growth Forecast Report By Type, Application, Power Source, Capacity, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Oil Free Air Compressors Market Size

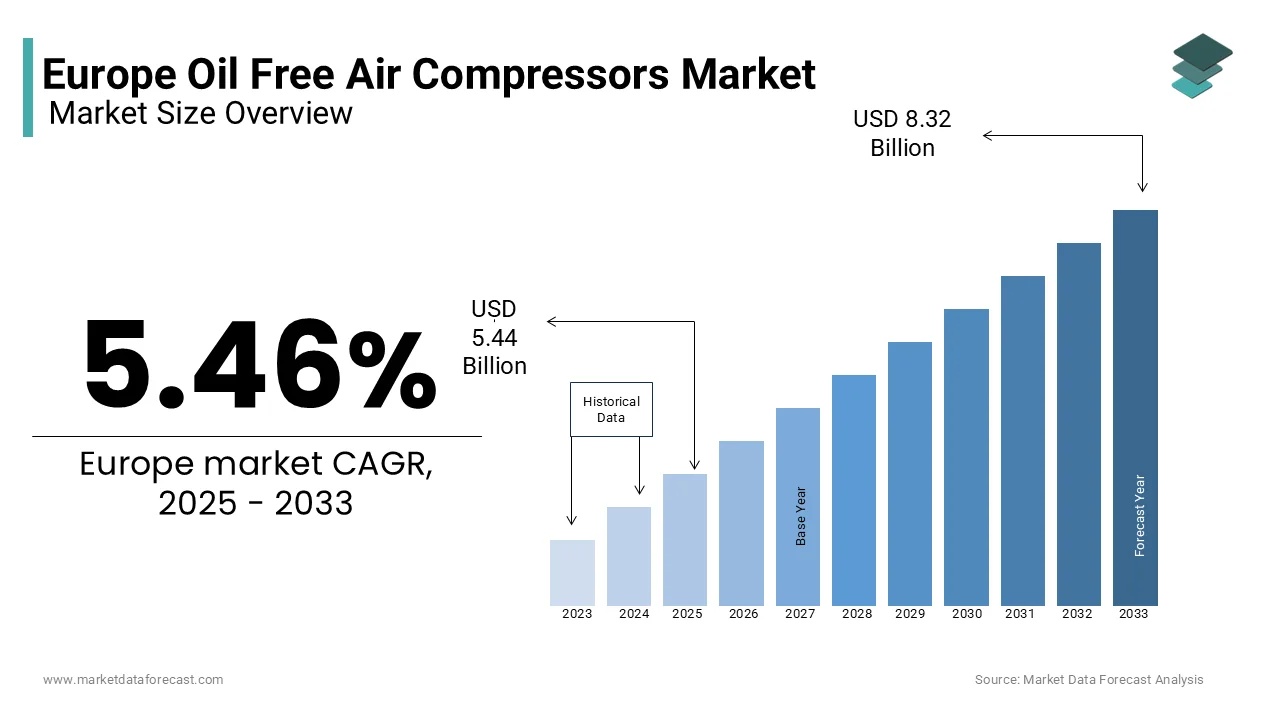

The Oil Free Air Compressors market size in Europe was valued at USD 5.16 billion in 2024. The European market is estimated to be worth USD 8.32 billion by 2033 from USD 5.44 billion in 2025, growing at a CAGR of 5.46% from 2025 to 2033.

Oil-free air compressors are designed to deliver high-purity air without the risk of oil contamination by making them indispensable in applications where hygiene, safety, and precision are paramount. Industries such as pharmaceuticals, food and beverages, healthcare, electronics, and chemical manufacturing rely heavily on these compressors to meet stringent regulatory standards and ensure product quality.

Europe’s focus in adopting green technologies has further propelled the adoption of oil-free compressors, which are more environmentally friendly compared to their oil-lubricated counterparts. According to the European Environment Agency, industries are increasingly transitioning to energy-efficient solutions to comply with carbon neutrality goals by 2050. Countries like Germany, France, and Italy have emerged as key contributors to this market due to their robust industrial bases and focus on innovation. Additionally, the rising adoption of Industry 4.0 technologies has spurred demand for smart, oil-free compressors equipped with IoT-enabled features for real-time monitoring and predictive maintenance. These factors collectively ensure the pivotal role of oil-free air compressors in shaping Europe’s industrial landscape while driving innovation, sustainability, and operational efficiency across multiple verticals.

MARKET DRIVERS

Stringent Regulatory Standards for Clean Air

The stringent regulatory standards mandating the use of contaminant-free compressed air in major industries is majorly driving the growth rate of the Europe oil-free air compressor market. According to the European Medicines Agency, pharmaceutical and food processing industries must comply with Good Manufacturing Practices (GMP), which prohibit the use of oil-lubricated compressors to avoid contamination risks. For instance, over 70% of European pharmaceutical manufacturers have adopted oil-free compressors to meet these standards, as reported by the European Federation of Pharmaceutical Industries and Associations. As per the European Food Safety Authority, the use of oil-free systems in food packaging and processing to ensure hygiene and safety is eventually increasing from recent years. These regulations have created a robust demand for oil-free compressors, particularly in Germany and France, where compliance-driven investments are highest.

Growing Demand for Energy-Efficient Solutions

The increasing demand for energy-efficient industrial equipment is spurred by Europe’s commitment to achieving carbon neutrality by 2050. According to the European Environment Agency, energy-efficient technologies, including oil-free compressors can reduce energy consumption by up to 30% compared to traditional systems. This has led to a surge in their adoption across industries such as electronics and chemicals, where energy costs constitute a significant portion of operational expenses. According to Eurostat, approximately 40% of European manufacturers have invested in energy-efficient machinery since 2020, with oil-free compressors being a key focus area. Furthermore, the European Commission’s Green Deal initiative promotes subsidies and incentives for adopting sustainable technologies that further boosts the market growth rate. Oil-free compressors have emerged as a preferred solution which is driving market growth across the region.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

High initial cost and ongoing maintenance expenses associated with these systems is likely to hinder the growth rate of the Europe oil free compressor market. According to the European Investment Bank, oil-free compressors can be up to 30% more expensive than oil-lubricated alternatives by posing a financial challenge for small and medium-sized enterprises (SMEs). Additionally, their complex design requires specialized maintenance, which further increases operational costs. As per Eurostat, nearly 60% of European SMEs cite budget constraints as a barrier to adopting advanced industrial equipment, including oil-free compressors. This financial burden limits their widespread adoption, particularly in price-sensitive industries such as food processing and textiles. While larger corporations may absorb these costs more easily, the affordability issue remains a key obstacle for broader market penetration. Many businesses opt for less expensive alternatives that is hindering the growth potential of the oil-free air compressor market.

Limited Awareness and Technical Expertise

The limited awareness and technical expertise regarding the benefits and operation of oil-free air compressor is degrading the growth rate of the Europe oil free air compressor market. As per European Agency for Safety and Health at Work, over 45% of industrial facilities in Eastern Europe lack adequate training on advanced technologies is leading to underutilization of oil-free compressors. This knowledge gap often results in misconceptions about their cost-effectiveness and suitability for specific applications. According to the European Industrial Gases Association, improper installation and operation due to insufficient expertise can reduce the lifespan of these compressors is discouraging potential adopters. The absence of widespread technical training programs exacerbates this issue in regions like Turkey and the Czech Republic. As a result, the lack of awareness and skilled personnel continues to impede the market’s growth across Europe.

MARKET OPPORTUNITIES

Expansion of the Pharmaceutical and Healthcare Sectors

The growing pharmaceutical and healthcare sectors in Europe present a significant opportunity for the oil-free air compressor market, which is driven by the need for contamination-free compressed air. According to the European Federation of Pharmaceutical Industries and Associations, the pharmaceutical industry in Europe is valued at over EUR 250 billion, with countries like Germany and France leading in production. Oil-free compressors are essential for applications such as drug formulation, packaging, and medical device manufacturing, where air purity is critical. According to the European Medicines Agency, the use of oil-free systems to comply with stringent hygiene standards is creating huge growth opportunities for the Europe oil free compressor market. According to Eurostat, healthcare investments in Europe increased by 15% between 2020 and 2022 is driven by the post-pandemic focus on medical infrastructure. This expansion creates a lucrative market for oil-free compressors in advanced medical facilities and biotechnology labs by ensuring sustained growth.

Adoption of Industry 4.0 and Smart Manufacturing Technologies

The rapid adoption of Industry 4.0 and smart manufacturing technologies across Europe offers another key opportunity for the Europe oil-free air compressor market. According to the European Association for Automation and Robotics, over 60% of manufacturers are integrating IoT-enabled machinery to enhance operational efficiency and reduce energy consumption. Oil-free compressors equipped with predictive maintenance and real-time monitoring capabilities align perfectly with these trends is making them ideal for modern industrial setups. The European Commission’s Green Deal initiative further supports this shift by promoting subsidies for energy-efficient technologies, including smart compressors. According to Eurostat, industries adopting IoT-enabled equipment reported a 20% reduction in downtime and a 25% improvement in energy efficiency. The demand for advanced oil-free compressors is set to rise as Europe accelerates its transition to smart factories. This factor is creating significant growth opportunities in sectors like electronics, automotive, and chemicals.

MARKET CHALLENGES

Intense Competition and Price Pressures

The intense competition and price pressures stemming from a crowded marketplace is a major factor that is challenging the market key players. According to the European Commission’s Industrial Policy Report, 50% of manufacturers face stiff competition from both domestic and international players, particularly from Asia, where lower-cost alternatives are prevalent. This competition often leads to price wars by reducing profit margins for European manufacturers striving to maintain quality and innovation. According to the Eurostat, nearly 35% of industrial buyers prioritize cost over advanced features, further intensifying the pressure on companies to offer competitive pricing. The affordability of imported compressors hinders the market growth rate. This challenge forces companies to balance innovation with cost-effectiveness is complicating efforts to sustain growth in an increasingly price-sensitive environment.

Supply Chain Disruptions and Raw Material Scarcity

The vulnerability to supply chain disruptions and raw material scarcity, exacerbated by geopolitical tensions and logistical bottlenecks is also one of the challenges for the market growth during the forecast period. According to the European Central Bank, over 60% of industrial equipment manufacturers experienced delays in sourcing critical components like motors and sensors in 2022, by impacting production timelines for oil-free compressors. As per European Chemical Industry Council, the rising cost of raw materials, such as aluminum and steel has increased manufacturing expenses by up to 20% in some regions. These disruptions not only inflate operational costs but also hinder timely delivery of products. As Europe remains heavily reliant on global supply chains by ensuring resilience and mitigating risks have become pressing concerns for the oil-free air compressor market by threatening its ability to meet growing demand efficiently.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.46% |

|

Segments Covered |

By Type, Application, Power Source, Capacity, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Sullair, Kobelco Compressors, Ingersoll Rand, compare, Anest Iwata,Kaeser Kompressoren, Hitachi, Eaton, Danfoss, Mitsubishi Electric, Parker Hannifin, ELGi Equipments, Gardner Denver, Atlas Copco, Boge Compressors, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The rotary screw compressors dominated the market and held 45% share of Europe oil free air compressor market in 2024. The ability to deliver continuous and high-capacity airflow with energy efficiency by making them ideal for industries like pharmaceuticals and food processing is leveraging the growth rate of this segment. According to the German Engineering Federation, over 60% of industrial applications requiring oil-free air rely on rotary screw compressors. Their reliability, low maintenance needs, and adaptability to various industrial demands ensure consistent performance. These attributes make them indispensable in Europe’s advanced manufacturing landscape anticipates their position in the coming years as well.

Scroll compressors segment is expected to register a CAGR of 8.7% during the forecast period. This growth is fueled by their quiet operation, compact design, and suitability for sensitive applications like healthcare and small-scale food processing. Scroll compressors are increasingly adopted for their energy-efficient designs as Europe emphasizes sustainability. Their compatibility with modern trends, such as IoT integration, enhances their appeal. Scroll compressors are poised to play a pivotal role in advancing Europe’s industrial innovation and meeting evolving operational needs.

By Application Insights

The manufacturing sector led the market by capturing a 35% of Europe oil free compressor market share in 2024. The widespread use of oil-free compressors in industrial applications like metal fabrication, automotive assembly, and pneumatic tools, where clean and reliable compressed air is highly important. According to the German Engineering Federation over 70% of large-scale manufacturing facilities in Europe rely on these compressors to meet energy efficiency and environmental standards. Their ability to reduce operational costs and improve productivity makes them indispensable.

The pharmaceuticals sector is witnessing to register a CAGR of 9.2% in the foreseen years. This growth is fueled by stringent regulatory standards, such as Good Manufacturing Practices (GMP), which mandate oil-free compressors for contamination-free air in drug production. According to the European Medicines Agency, compliance with hygiene and safety norms has driven adoption. Europe’s pharmaceutical companies investments in advanced manufacturing technologies further boost the growth rate of this segment

By Power Source Insights

The electric-power source segment dominated the market and held 65% of Europe oil free compressor market share in 2024. Energy efficiency, low emissions, and alignment with Europe’s sustainability goals are solely to enhance the growth rate of the market to the extent. As per European Environment Agency, over 80% of industrial facilities in urban areas rely on electric compressors to comply with stringent environmental regulations. Their ability to reduce operational costs while ensuring reliable performance makes them indispensable in sectors like manufacturing, healthcare, and food processing.

The electric-power source segment is attributed to experience a CAGR of 7.8% during 2025-2033. This growth is fueled by Europe’s Green Deal initiative, which promotes energy-efficient technologies through subsidies and incentives. The European Commission reports that industries adopting electric systems have reduced energy consumption by up to 30%. Electric compressors are increasingly adopted for their low emissions and cost-effectiveness by positioning them as a key driver of innovation and environmental compliance in the industrial sector.

By Capacity Insights

The 5 HP to 15 HP segment dominated the market and held 35% of the Europe oil-free air compressor market share in 2024. Its versatility and suitability for industries like food and beverage, pharmaceuticals, and small-scale manufacturing where moderate air pressure and flow rates are essential is enhancing the new opportunities for this segment to grow in the coming years. According to the European Environment Agency, this segment benefits from Europe’s focus on energy-efficient technologies, with over 70% of mid-sized industrial facilities adopting these compressors to meet sustainability goals. Their balance of performance, affordability, and compliance with regulatory standards makes them indispensable by ensuring consistent demand across diverse applications.

The below 5 HP segment is predicted to witness a CAGR of 8.5% during the forecast period by owing to the increasing demand in healthcare, laboratories, and small-scale commercial applications, where compact and portable compressors are critical. According to the European Health Technology Association, over 60% of healthcare facilities rely on these compressors for medical tools and equipment. The demand for small-capacity compressors is rising as Europe expands its healthcare infrastructure and supports small businesses by positioning this segment as a key enabler of innovation and accessibility in the market.

By End-User Insights

The automotive sector is the largest segment with a 30% Europe oil free air compressor market share in 2024. The widespread use of oil-free compressors in major applications like painting, pneumatic tools, and assembly lines, where air purity is essential is elevating the growth rate of the market. According to the German Engineering Federation, over 75% of automotive facilities in Europe rely on these compressors to meet environmental and safety standards. Their ability to enhance productivity while ensuring compliance with regulations elevates their dominance in this high-demand sector.

The energy sector is expected to witness a fastest CAGR of 9.2% during the forecast period. This growth is driven by Europe’s transition to renewable energy and hydrogen-based solutions, where oil-free compressors play a vital role in electrolyzers, hydrogen refueling stations, and carbon capture systems. As Europe targets 40 gigawatts of renewable hydrogen capacity by 2030, the demand for oil-free compressors in energy applications is set to rise by positioning this segment as a key enabler of sustainable industrial innovation and clean energy initiatives.

REGIONAL ANALYSIS

Germany was the top performer in the Europe oil free air compressor market and accounted for 25% of share in 2024 owing to the country’s robust industrial base in automotive manufacturing, pharmaceuticals, and electronics, where oil-free compressors are indispensable for precision and compliance with stringent regulations. According to the European Environment Agency, Germany accounts for over 30% of Europe’s industrial automation investments that further boosts the demand for advanced compressors. Additionally, Germany’s prominent role in renewable energy projects, such as hydrogen production, amplifies the need for oil-free systems. The country’s focus on sustainability and innovation ensures steady adoption of energy-efficient technologies.

France is witnessing to register a CAGR of 7.2% during the forecast period. The country’s prominence stems from its strong pharmaceutical and food processing industries, which rely heavily on oil-free compressors to meet hygiene and safety standards. According to the European Food Safety Authority, France is one of Europe’s largest food exporters is driving demand for contamination-free compressed air solutions. Furthermore, France’s commitment to renewable energy, including green hydrogen initiatives, has increased the adoption of oil-free compressors in energy applications. The French government’s subsidies for sustainable technologies further bolsters the growth rate of the market.

Italy is anticipated to showcase steady growth opportunities in the Europe oil free compressor market. The country’s growth rate is fueled by its thriving manufacturing sector, particularly in textiles, automotive, and food processing, where oil-free compressors ensure product quality and regulatory compliance. According to the European Textile Machinery Association, Italy is a global leader in textile production by creating significant demand for reliable compressed air systems. Additionally, Italy’s focus on modernizing its industrial infrastructure through Industry 4.0 initiatives has spurred investments in energy-efficient technologies. This emphasis on innovation and sustainability reinforces Italy’s position as a key contributor to the Europe oil-free air compressor market.

KEY MARKET PLAYERS

The major key players in Europe Oil Free Air Compressors market are Sullair, Kobelco Compressors, Ingersoll Rand, compare, Anest Iwata,Kaeser Kompressoren, Hitachi, Eaton, Danfoss, Mitsubishi Electric, Parker Hannifin, ELGi Equipments, Gardner Denver, Atlas Copco, Boge Compressors, and others.

MARKET SEGMENTATION

This research report on the Europe oil free air compressors market is segmented and sub-segmented into the following categories.

By Type

- Rotary Screw Compressors

- Reciprocating Compressors

- Scroll Compressors

- Centrifugal Compressors

By Application

- Manufacturing

- Healthcare

- Food and Beverage

- Pharmaceuticals

- Electronics

By Power Source

- Electric

- Hydraulic

- Diesel

By Capacity

- Below 5 HP

- 5 HP to 15 HP

- 16 HP to 30 HP

- Above 30 HP

By End User

- Automotive

- Construction

- Textiles

- Aerospace

- Energy

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size for oil-free air compressors in Europe?

The market is estimated to grow from USD 5.44 billion in 2025 to USD 8.32 billion by 2033, at a CAGR of 5.46% from 2025 to 2033.

2. What is the overall impact of these challenges on market growth?

ntense competition, price pressures, and supply chain issues slow down market growth, making it difficult for manufacturers to scale operations, maintain profitability, and meet demand efficiently. Overcoming these hurdles is crucial for the sustained expansion of the European oil-free air compressor market.

3. Which country led the Europe oil-free air compressor market in 2024?

Germany was the top performer, accounting for 25% of the market share in 2024. The country’s strong industrial base in automotive manufacturing, pharmaceuticals, and electronics drives demand for oil-free compressors.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]